Acquired Financial Deficiency

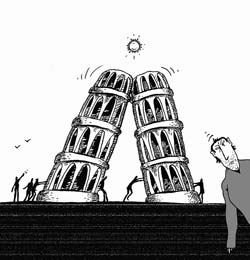

“Our government is the main risk factor for the nation’s economy”

For the first time ever the government has finally admitted that it has failed in its mission to secure unprecedented levels of foreign investment in the country’s economy. This follows from a recent statement by First Deputy Prime Minister Anatoly Kinakh, who said that between January and June of this year the inflow of investments declined by 14% compared to the same period last year. He explained this by the fact that Ukraine has yet to implement effective mechanisms for the protection of ownership rights. As he put it, the absence of such mechanisms is discouraging investors and harming the economy. However, this softly-worded explanation does not adequately describe either the complexity of the problem or the government’s role in causing it. What kind of investment climate is there to speak of if the government has decided to include the prized Ukraina Hotel in the list of assets slated for privatization, even though the hotel is at the center of a court battle that is far from over? This is one example of undue pressure on the justice system.

At the same time, pro-government macroeconomists say that a surge in investment activity could have undesirable consequences, such as increasing inflation. Have we reached this level today?

Oleksandr PASKHAVER, presidential aide:

“How can investment growth be a risk factor for the economy given the Ukrainian reality? It is absolutely irrelevant to speak of the economy overheating. This is tantamount to diagnosing a victim of suffocation with oxygen poisoning. You can make up countless risks, but they are irrelevant to our economy. It is now slowing down at a fast rate, and growth has already been reversed in individual sectors. So, now is not the time to speak of surplus investment, only of a lack of investments. Ukraine is now experiencing a clear-cut deficit of both private and government investments in manufacturing. Let us hope that this process will be reversed soon and that investment will grow rather than shrink. Speaking optimistically, this process can be compared to house cleaning, which always creates a mess. If this is the case, it’s time for the government to stop cleaning our economic house and start living by the rules. Maybe then the economic slowdown will stop. But this is a long process, and next year is too soon to hope for this to happen.”

Volodymyr ULYANOV, first deputy chairman of the National Depository of Ukraine:

“Any economy can develop only if it doesn’t have enough investment. Yet in this case we must draw a clear dividing line between foreign investment and all other forms of investment in the economy. I know nothing about the general drop in investment growth. However, the fact that the inflow of foreign capital into the country is lessening is undeniable. I think that the biggest problem of our economy is the lack of a civilized and developed equity market. That’s the whole problem.

“In the wake of the 9/11 terrorist attacks in the US, the breaking news releases on the crisis and the number of casualties were immediately followed by financial market reports. The focus of these reports was not the US dollar, but the Dow Jones index — an indicator of what is happening in the equity market and its condition. Reports on currency exchange rates and oil prices came later. Here everything is different. We appear to live on the other side of the looking glass, oblivious to the equity market. Until it begins working and a corresponding infrastructure is created, no investor in his right mind will risk investing in our economy without knowing what kind of profits he will earn and whether his ownership rights will be protected. If we had an equity market, today there would be no talk of declining investments. Investors need to be certain that their stocks are liquid and can be sold at any moment.”

Victor LYSYTSKY, former state secretary in Yushchenko’s Cabinet of Ministers:

“The drop in the volume of foreign investments is definitely a threat to the Ukrainian economy. However, this drop can be considered relative: in the first half of 2004 there was half a billion USD in foreign investments; this year the volume of investments has remained the same, even though the economy has expanded. There has been no significant increase in capital investment either. The government has provoked investment starvation. Moreover, the temperature drop in the economy is also due to the shortage of investments. This makes our government the main risk factor for the economy. So far surplus investment in Ukraine is unrealistic, which is why it would be nonsensical to speak of its adverse economic effect. This could be the case with portfolio investments, whereas direct investments are made on specific projects, which is why there are no idle investments. Things would be different if the overall situation stimulated the inflow of funds and we had a large number of readily available investment projects. Then it would make sense to speak of sterilizing excessive money supply as an inflationary control measure. But we are still a long way from this.”

Andriy KOLODIUK, president of the Information Society of Ukraine Fund:

“I consider the insufficient inflow of investments from abroad to be a risk factor for the Ukrainian economy. It is much too early to speak of the over-saturation of the economy by foreign capital. Our economy is undercapitalized by several orders of magnitude. There are individual sectors with sufficient investment, where the concentration of investment is nearing saturation. But this is the exception rather than the rule. Globally speaking, our economy lacks funds. I am even curious to know if there are people in Ukraine who sincerely believe in the threat of excessive investments to our economy. If there are, I would like to hear their arguments.”